Current mortgage interest rates in San Antonio Texas

San Antonio Mortgage: Understanding the current mortgage interest rates!

As a homeowner or potential homebuyer in San Antonio, TX, understanding current mortgage interest rates is crucial to making informed decisions about your home loan options. In this blog post, we’ll break down what mortgage interest rates San Antonio TX are, how they’re determined, and what you can do to secure the lowest possible rate for your home loan.

What are mortgage interest rates?

Mortgage interest rates are the percentage of your loan balance that you’ll pay in interest over the life of your mortgage. These rates can vary depending on a number of factors, including your credit score, the type of loan you’re applying for, and market conditions.

How are mortgage interest rates determined?

Mortgage interest rates are influenced by a number of factors, including:

- The state of the economy: When the economy is strong, mortgage interest rates tend to rise. Conversely, when the economy is weak, rates tend to fall.

- Inflation: When inflation is high, mortgage interest rates tend to rise to compensate for the decreased value of money over time.

- The Federal Reserve: The Federal Reserve can influence mortgage interest rates by adjusting the federal funds rate, which is the interest rate that banks charge each other for overnight loans.

What can you do to secure the lowest possible mortgage interest rate?

There are several steps you can take to increase your chances of securing a low interest home loan rates, including:

- Improving your credit score: Lenders typically offer lower interest rates to borrowers with higher credit scores, so taking steps to improve your credit can pay off in the long run.

- Shopping around for the best rate: Don’t settle for the first mortgage offer you receive. Shop around and compare rates from different lenders to find the best deal.

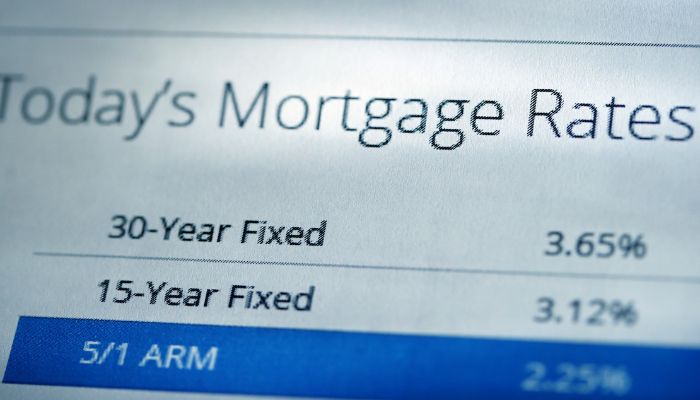

- Considering an adjustable-rate mortgage (ARM): ARMs often offer lower interest rates than fixed-rate mortgages, but they have the risk of rates increasing over time.

- Putting down a larger down payment: Lenders often offer lower interest rates to borrowers who put down a larger down payment, as it reduces their risk.

Conclusion

Understanding mortgage interest rates is critical to making informed decisions about your home loan options. By knowing what influences interest rates and taking steps to secure the lowest possible rate, you can save thousands of dollars over the life of your mortgage. At San Antonio Mortgage, we’re here to help you navigate the complex world of mortgage interest rates and find the right loan for your unique needs. Moreover, In addition, you should select us because we are the only mortgage lender that provides the industry’s most affordable private mortgage insurance rates in San Antonio, Texas!